TOP Ships Inc. (NASDAQ:TOPS) inches down in pre trading session on Tuesday as the firm releases that it has entered into a securities purchase agreement with several institutional investors to purchase approximately $13.6 million of its units in a registered direct offering at a price of $1.35 per unit in a registered direct offering. Each unit will be comprised of one common share and one warrant and will be issued in two parts.

The warrants will be immediately exercisable, have a five-year expiration date, and an exercise price of $1.35 per common share. Furthermore, the Company has agreed to reduce the exercise price per common share under its existing Class C warrants issued to investors on December 6, 2022 to $1.35 per common share from an original exercise price of $2.00 per common share.

In connection with the offering, Maxim Group LLC is acting as the sole placement agent. The offering is expected to close on or around February 16, 2023, subject to customary closing conditions being met.

Top Ships Inc. Updated Revenue Backlog of $280 Million

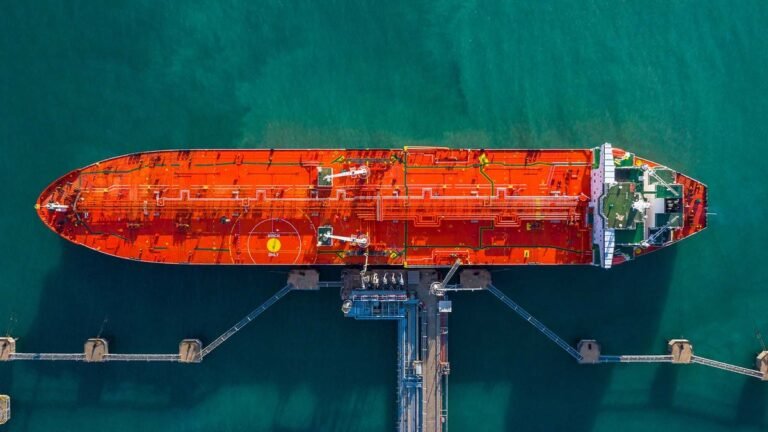

TOP Ships Inc. (NASDAQ: TOPS) announced that it has entered into a time charter employment contract for its product/chemical tanker M/T Eco Marina Del Rey with a high-quality counterparty. The new time charter will begin immediately after the current time charter employment contract expires in the first quarter of 2024 and will have a firm duration of three years with the option of an additional year at the charterer’s discretion.

The revenue backlog generated by this fixture is expected to be approximately $22.4 million for the firm period and approximately $30.6 million if the charterer exercises the option to extend for an additional year.

The President, Chief Executive Officer and Director of the Company, Evangelos Pistiolis said: they are very pleased to have completed this new fixture of M/T Eco Marina Del Rey more than a year ahead of the expiration of its current employment and at a daily rate that is approximately 36% higher than the current rate, allowing them to capitalize on the current tanker market’s strong rates. After accounting for this fixture, the total gross revenue backlog for the firm time charter period of their operating vessels as of December 31, 2022 is approximately $259 million, rising to approximately $280 million when the 50% of their joint venture vessels are included.